Global economic growth will continue to slow in 2023, according to the World Bank’s January 2023 Global Economic Prospects report, which noted that any new shock to the world economy could push us into the second global recession in three years.

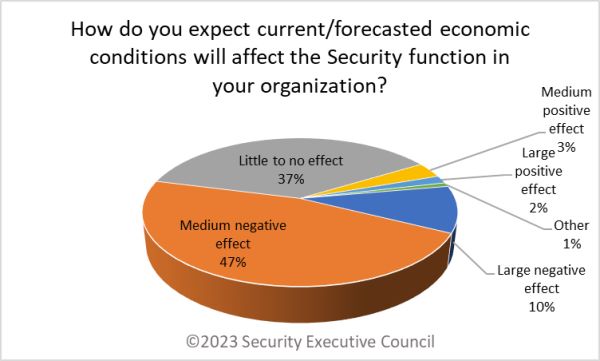

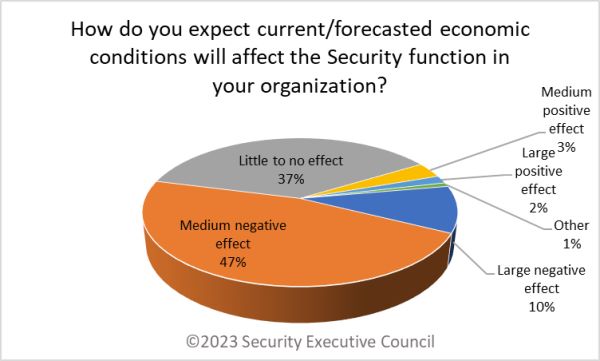

We launched a Security Barometer quick poll to ask security leaders how they expect these economic conditions to affect their functions.

Forty-seven percent of respondents reported they expect to see a medium negative effect on the security function. Ten percent forecast a large negative effect, and 37% expect to see little to no effect.

Three percent expect a medium positive effect and 2% a large positive effect.

Participants were next asked to explain their answers.

A significant number of respondents commented that staffing and investment have already suffered in 2022, and more of the same is expected. Others noted that increased security threats are likely to surface – both internal threats from stressed and under-resourced employees, and external threats through theft.

Below is a partial list of the responses we felt would be most interesting to our readers, edited for clarity and anonymity.

- Spending halted in 2020, but the world didn't end so it was difficult to convince business leaders to invest in security so we didn't really recover; going into recession I have little hope that security investment will re-emerge.

- Additional investment is not being approved. Current investments are being questioned more and, in some cases, reduced.

- Market downturns and the associated capital shortage will cause the business to tighten the purse strings across the board. Security - both in existing guard force allocation and future facility security system design - will be a potential victim of budget challenges.

- My industry is driven by travel, which as seen an upward swing now that Covid restrictions have become more relaxed. As such, our revenue appears to be returning to pre-Covid levels, despite the forecasted economic conditions.

- Company is doing quite well financially with strong results. In addition, company is looking to build up security function. Costs of security function are immaterial to overall company results. Physical security upgrades and enhancements at company locations may be more closely evaluated for incremental cost to each site but should not impact security function itself.

- Physical security will have its hands full with the breaking and entering of construction sites that have been abandoned equipment or improperly stored on site. Mainly catalytic converter and copper wiring theft will be a concern.

- Recession and weak near-term national economic forecast necessitated aggressive cuts to make earnings. This has resulted in enterprise-wide workforce reductions. For security, this includes guard-force reductions and holding vacancies.

- Sales expected to remain relatively flat or slow decline for the next one or two years. Supply chain largely domestic and resilient. Layoffs not expected and total compensation and reward for employees expected to remain competitive. Security may need to respond to increased WPV threats related to terminations if U.S. experiences high unemployment.

- Cost reduction efforts with new budget targets in anticipation of economic downturn. The biggest impacts are typically with contract services such as guard force operations.

- As a wholesale grocery distributer, the increasing price of food will create more frequent theft of product both internal and external. Additionally, the price of diesel fuel will increase the potential for theft of diesel from our delivery trucks and storage tanks.

- In response to the current economic environment, we are being asked to reduce/delay/cancel key projects or solutions.

- If we remain in a downturn for over a year it will begin to have an impact, but anything under 12 months won't have an effect.

- There is not much more that can be taken. We are minimally staffed to support our core functions. Any further cuts would mean cutting functions. We were hoping for some recovery in 2023 from the staffing and resource cuts we sustained as a result of the pandemic; the economic outlook makes it more likely that we do not see that relief.

- As wages rise, our industry is competing with others for high quality labor. It will affect all positions, both security officers and leaders. The economy and supply chain shortages will also continue to hamper our efforts to make security improvements and keep up with life cycle replacements of old hardware. Although many companies seem to be scoring record profits, they are likely needed to counter losses experienced during COVID. Many industries are making tough decisions regarding capital investments, and security is not always top of list.

- Whilst economic pressures are real, the organization has a clear understanding of the threats a weakened economy will generate.

- U.S. Crime Index reporting and other probability indicators for 2023 suggest with the current overall economic slowing that incidents of theft will increase as inflation adversely impacts the finances of households in the U.S. Also reported for 2023 is an increased probability of incidents of workplace discord and violence caused by these same fiscal factors straining personal finances.

- Well, unfortunately most F100 companies still place security at the bottom of the priority list and the security almost always is the first to get hit with budget cuts; I’ve seen this happen at least 3 times over the past 15-20 years.

- Downturn in "good" security staff, increase in poor security staff and an even bigger increase of desperate individuals/families.

- We have already seen an impact at the end of Q3 to headcount and budget, however we are adding some new roles with expanded responsibility and leaning heavy on contract workers/vendors into 2023.

Additional Insight

Responding to a Changing Risk Picture in an Economic Downturn

Managing and Defending a Security Budget: Laying a Foundation

Dealing with Security Budget Challenges

How Does Your Insider Threat Compare?

Insider Threat Is a Challenging Organizational Problem

You can download a PDF of this page below: